The article titled “Is the USD Setting Up for a Perfect Rally?” explores the potential factors driving a rally in the value of the US dollar. In recent times, the USD has experienced fluctuations due to various economic and geopolitical factors. This article aims to analyze the current market conditions and indicators that suggest a possible strengthening of the USD in the near future.

The article discusses the impact of the Federal Reserve’s monetary policy on the value of the USD. The Federal Reserve plays a crucial role in determining interest rates and implementing monetary policies that influence the strength of the currency. As the Fed monitors economic indicators and inflation rates, its decisions regarding interest rates can either bolster or weaken the USD. The recent hawkish stance taken by the Fed signals a potential increase in interest rates, which could attract foreign investors and lead to a rally in the USD.

Moreover, the article emphasizes the importance of geopolitical tensions and their impact on the USD. Geopolitical events such as trade disputes, political instability, and conflicts can affect investor sentiment and drive capital flows towards safe-haven assets like the USD. In times of uncertainty, investors seek refuge in stable currencies, thus boosting the value of the USD. The ongoing tensions between the US and China, as well as other global powers, could contribute to a rally in the USD as investors shift their focus to safer assets.

Additionally, the article highlights the role of economic data and market sentiment in driving the value of the USD. Positive economic indicators such as strong GDP growth, low unemployment rates, and robust consumer spending can bolster investor confidence in the US economy, leading to increased demand for the USD. Market sentiment also plays a crucial role in shaping currency movements, as perceptions of political stability, economic growth prospects, and global trade dynamics influence investor decisions.

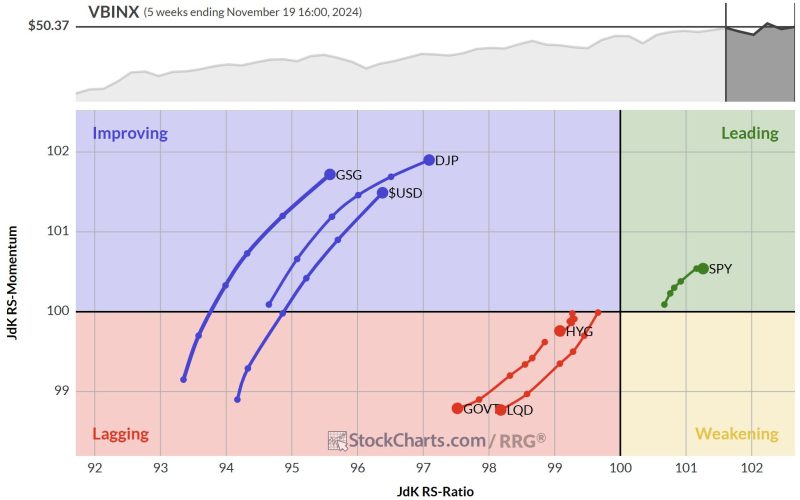

Furthermore, the article examines technical analysis as a tool to gauge potential trends in the currency market. By analyzing historical price data and chart patterns, traders can identify key support and resistance levels that indicate potential turning points in the market. Technical indicators such as moving averages, stochastic oscillators, and relative strength indexes can help traders anticipate market movements and make informed trading decisions.

In conclusion, the article provides a comprehensive analysis of the factors contributing to a potential rally in the value of the USD. From the Federal Reserve’s monetary policy to geopolitical tensions and economic data, various factors are aligning to suggest a strengthening of the USD in the coming months. By monitoring these key indicators and staying abreast of market developments, investors can position themselves to capitalize on potential opportunities in the currency market.