The article titled Short-Term Bearish Signal as Markets Brace for News-Heavy Week from GodzillaNewz highlights key indicators suggesting a potential downturn in the market. As investors prepare for a week packed with significant news events, the article warns of a short-term bearish trend on the horizon. In this analysis, we will delve deeper into the factors contributing to this outlook.

One of the primary factors driving the bearish sentiment is the anticipation of news-heavy events. The upcoming week is expected to see a flurry of economic reports, corporate earnings releases, and geopolitical developments that could sway market sentiment. This heightened uncertainty often leads to increased volatility as investors navigate through the influx of information.

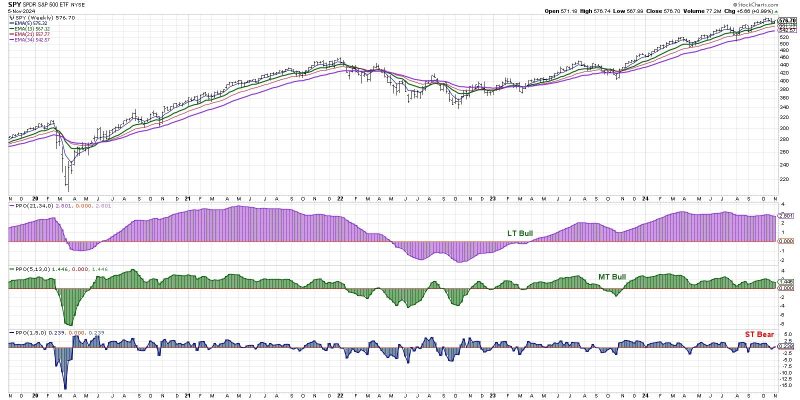

Additionally, the article points to technical indicators that support the short-term bearish signal. The market’s recent performance, combined with patterns such as moving averages and chart formations, suggest a potential downward movement in the near future. These technical signals serve as a red flag for traders and investors monitoring market trends.

Moreover, concerns surrounding inflation and rising interest rates have also contributed to the bearish outlook. With inflationary pressures mounting and central banks hinting at policy tightening measures, market participants are bracing for possible impacts on asset valuations and overall market dynamics. This macroeconomic backdrop adds another layer of uncertainty to an already complex investment landscape.

Furthermore, geopolitical tensions and global events are playing a significant role in shaping market sentiment. From trade disputes to geopolitical conflicts, the impact of external factors on financial markets cannot be understated. As investors weigh the implications of these developments, the potential for a short-term market correction becomes increasingly apparent.

In conclusion, the article’s analysis presents a comprehensive overview of the factors driving the short-term bearish signal in the markets. As investors prepare for a news-heavy week fraught with uncertainty, it is crucial to remain vigilant and adaptive in navigating the evolving market conditions. By keeping a close eye on key indicators and developments, market participants can position themselves effectively to weather potential downturns and capitalize on new opportunities that may arise.