Amidst the volatile market conditions witnessed recently, the Nifty50 index is expected to witness a stable start in the upcoming week. Traders and investors are likely to approach the market cautiously due to the prevalent selling pressure at higher levels.

The previous week saw the Nifty50 witnessing significant volatility, with sharp intraday swings keeping market participants on their toes. As the market is grappling with uncertainties related to the economic recovery amidst the ongoing pandemic situation, investor sentiment remains fragile.

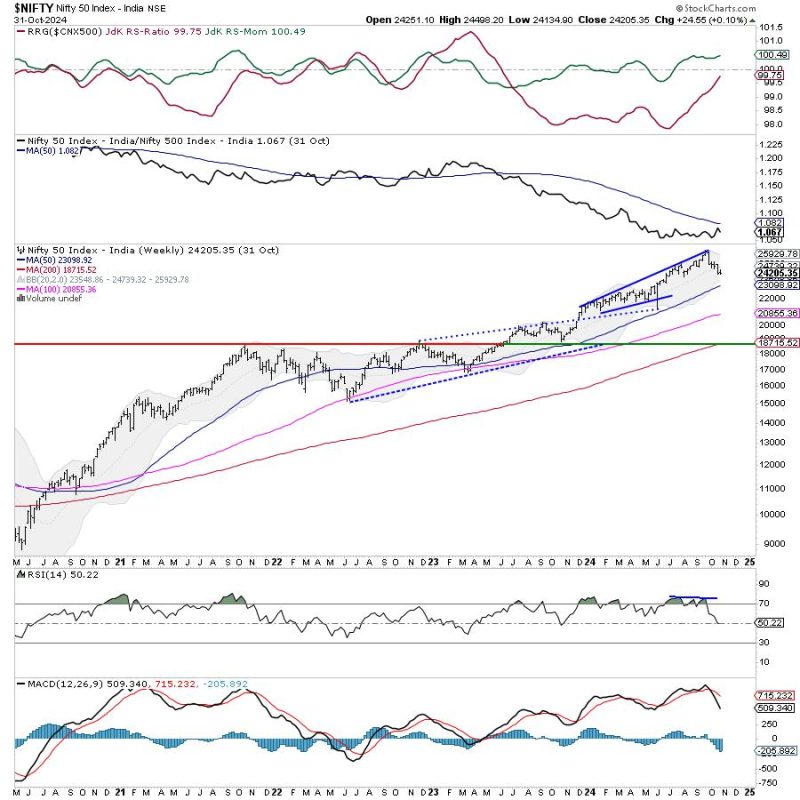

Technical analysis suggests that the Nifty50 may face resistance at higher levels, leading to selling pressure. Key resistance levels to watch out for include 15,000 and 15,200, while support levels stand at 14,400 and 14,200. Traders are advised to be vigilant and cautious in their approach, keeping stop-loss orders in place to manage risk effectively.

The trend of sectoral rotation may continue, with sectors like IT, Pharma, and FMCG expected to witness sustained interest from investors. On the other hand, cyclicals and economically sensitive sectors may face headwinds due to concerns regarding the global economic outlook.

Market participants should monitor global cues, especially developments related to inflation, interest rates, and geopolitical tensions, as these factors can impact market sentiment and direction. Additionally, the upcoming earnings season will be crucial in determining the market trend, with corporate performance being closely scrutinized by investors.

In conclusion, while the Nifty50 may see a stable start in the upcoming week, it is likely to remain under selling pressure at higher levels. Traders and investors are advised to adopt a cautious approach, staying informed about market developments and adjusting their strategies accordingly to navigate the prevailing market uncertainties effectively.